Scotiabank

Accepting a pre-approved credit card offer is a simple process for customers with online banking access. However, half of Scotiabank customers were not digitally active and they currently accept the offer by either calling or going to the branch. Scotiabank wanted to explore how we could further drive the digital adoption and digital sales by offering an online option for digitally inactive customers.

Challenges

Once customers are authenticated within online banking space, they can securely update their info and accept the offer. The public space did not offer such security. Being able to verify the customer's identity is important in preventing fraud and protecting the customer.

Before building the fully automated online verification option, the team decided to go with manual verification of the customer to quickly build and test the online option.

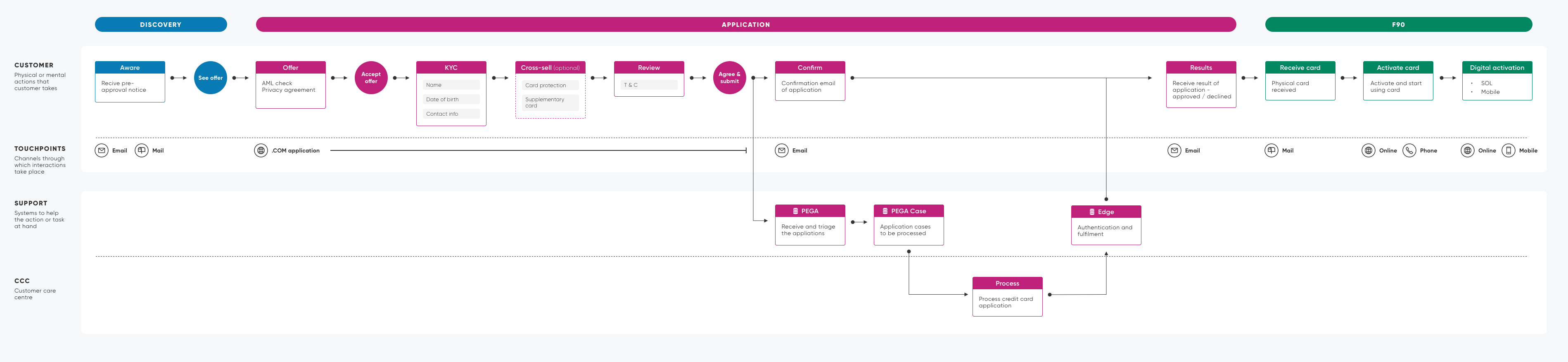

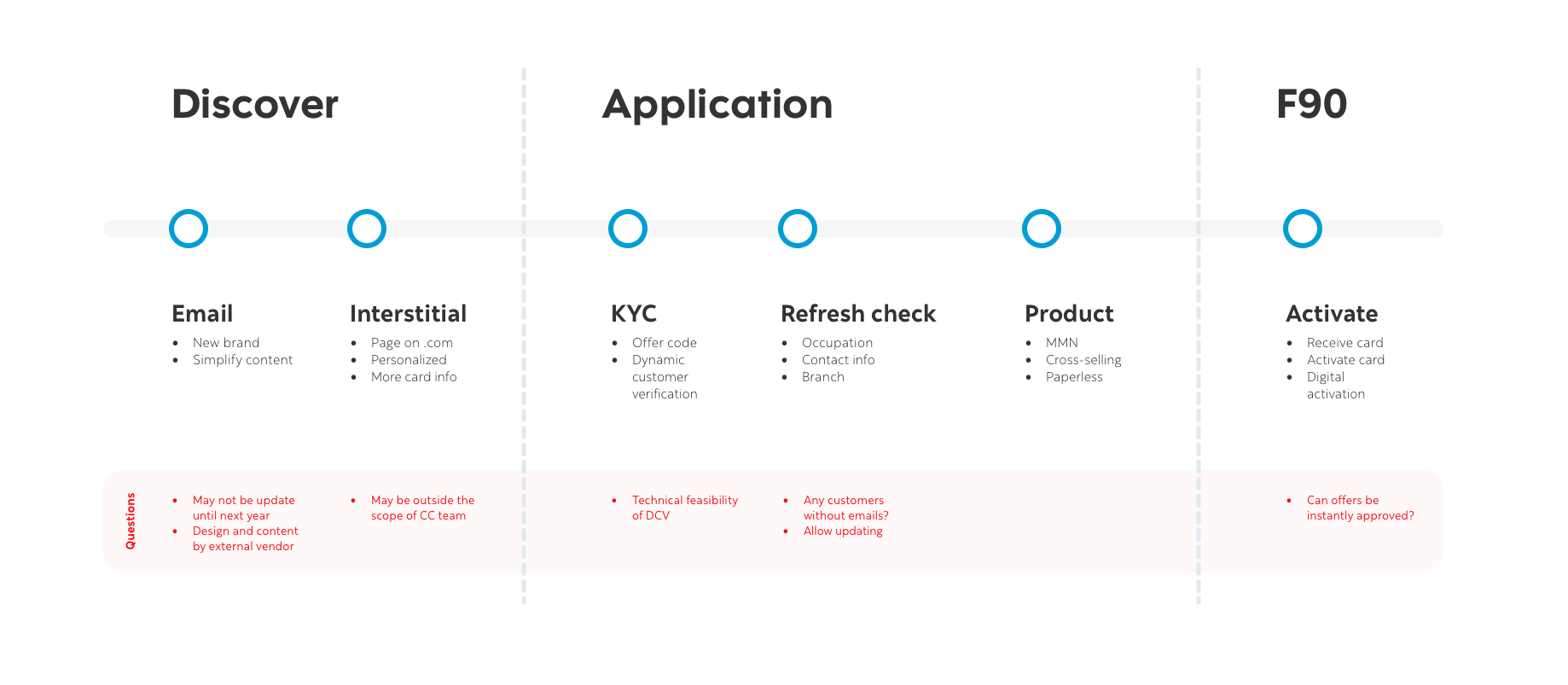

This journey map shows full end-to-end experience of accepting a pre-approved offer. It starts with the discovery phase where a customer receives the offer. The application phase shows both online application process and manual verification by the contact centre.

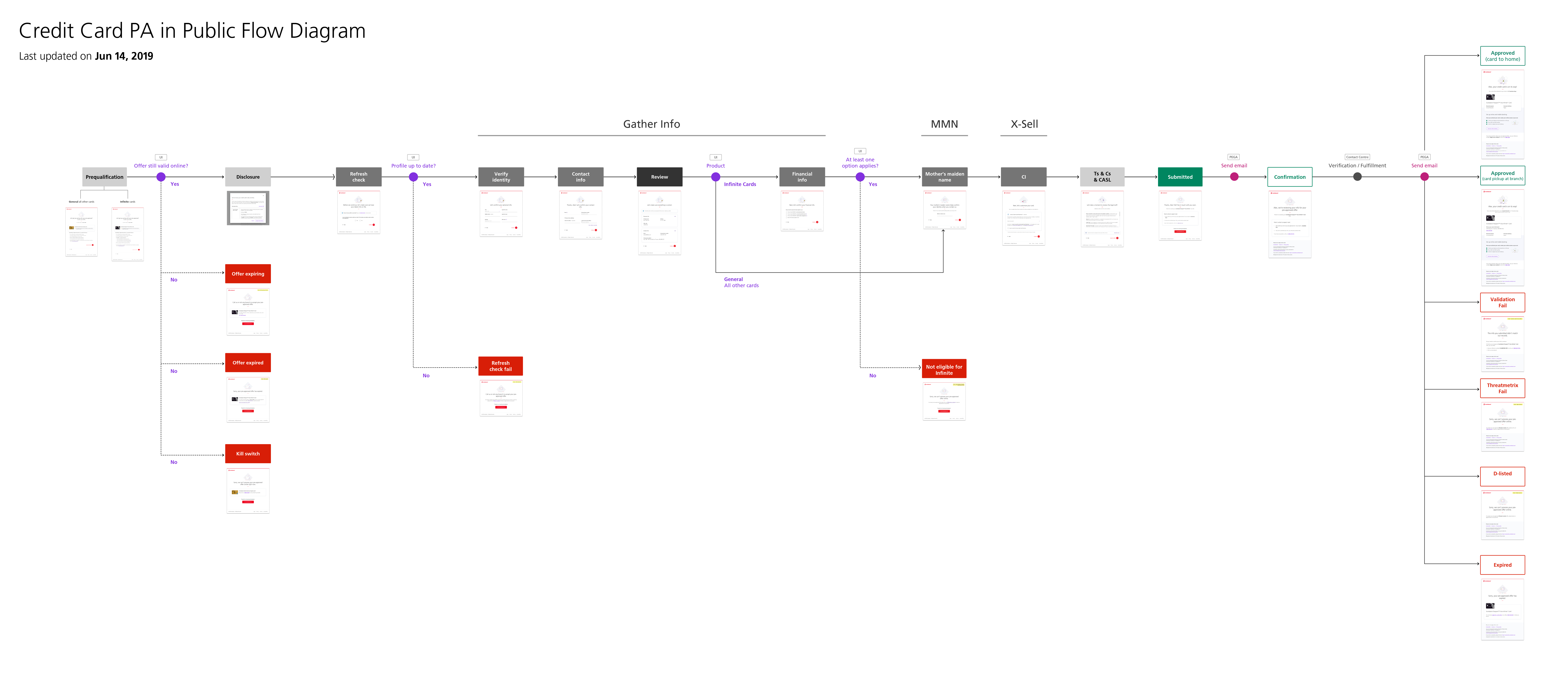

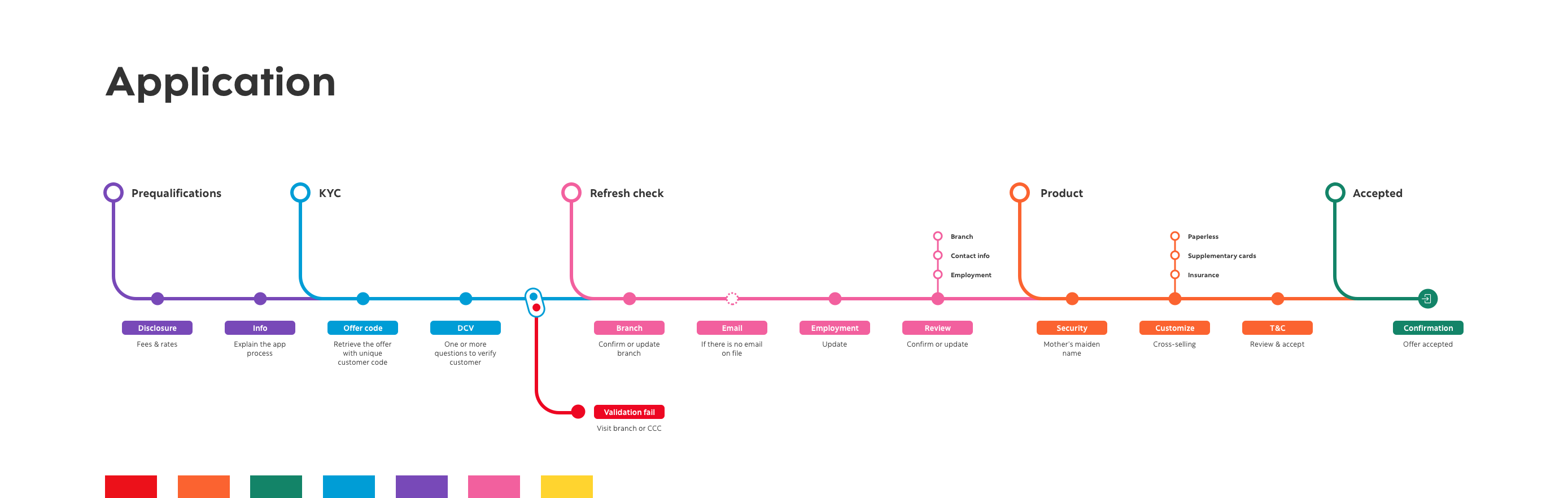

This flow diagram shows each step that a customer goes through to provide the necessary information and considers various outcomes. What happens if the customer can't be verified? What are the possible error states from the manual verification process?

Testing

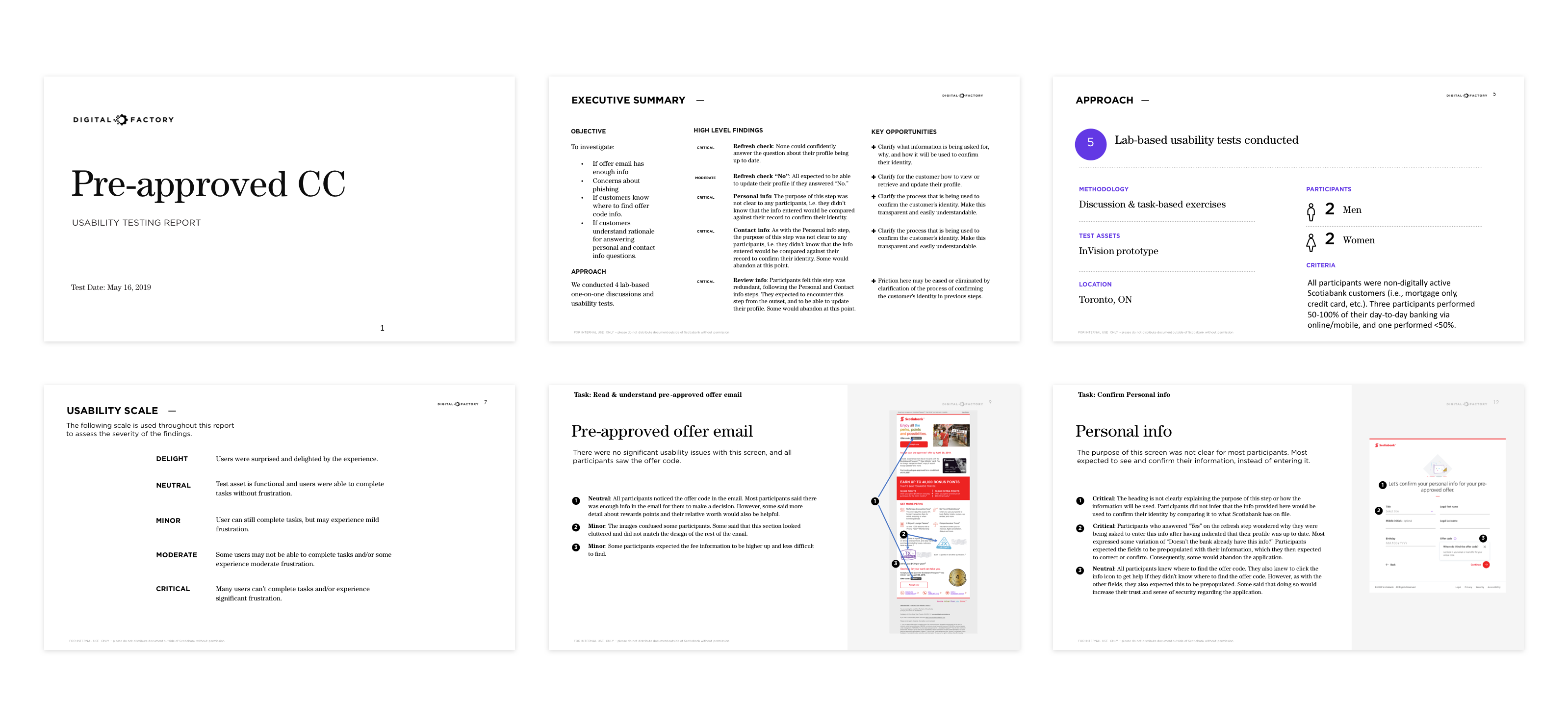

Aside from the security issue, we wanted to address and validate other concerns and assumptions:

- Marketing emails had different branding than the application - would the customers be concerned with phishing?

- Is there enough info in the email for them to continue?

- Do they understand why they have to enter information to accept the offer?

We prepared a full-day user testing session with four participants. InVision prototype was used to perform the task of accepting the offer and completing the application.

Optimize

From the user testing results, we addressed the issues that could be quickly fixed for the first campaign rollout. For other issues, we decided to wait for the KPI numbers from the pilot campaign.

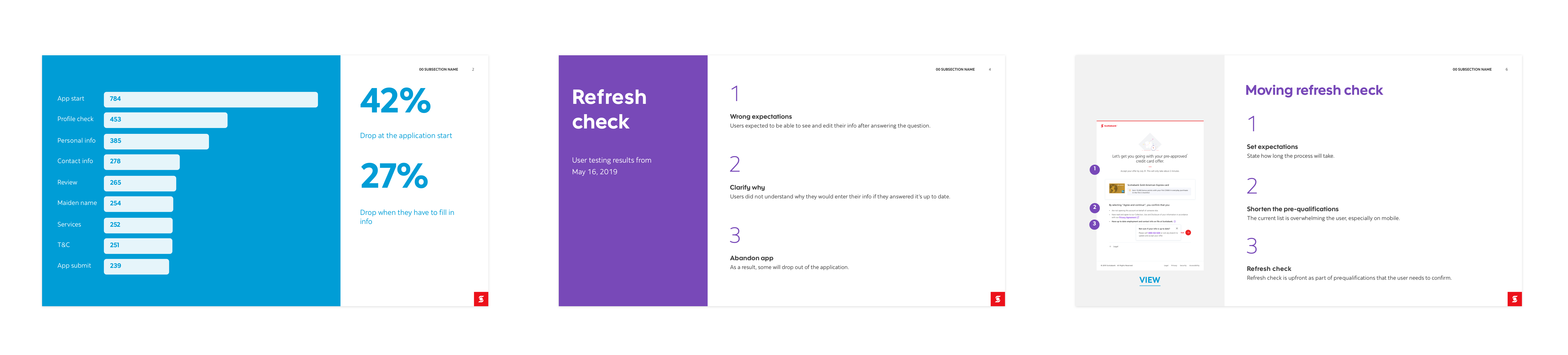

We saw that there is a significant drop when the user is being asked to fill in their information. There were a couple of issues at hand:

- From the user testing, we realized that the users expected to see their information pre-populated.

- Users could not confirm that their info is up to date with confidence. Confirming this is a banking legal requirement.

For the next campaign rollout, we are addressing this by moving this requirement upfront and clarify why they are being asked to fill out their information.

Next

With fully automated version, we can even better address this issue by presenting the current profile info and asking customers to confirm and update as needed.

I explored what are the opportunities from an automated process and what are the possible impediments and questions that we need to investigate.

Considering these in mind, I made a detailed process of automated digital application and how the dynamic verification will be completed.

In the meantime, we're further optimizing the application by looking at the funnel data and exploring a different discovery route for the customer.